Showing posts with label consumer. Show all posts

Showing posts with label consumer. Show all posts

Saturday, November 18, 2017

Resurgence of progress in a leading Rizal town, consumer and investment led

Ateneo Professor on Entrepreneurship

Rizal Philippines

Novemer 18, 2017

Tanyag Tiangge ng Taytay

for cheap but quality products

Dinadayo ng marami

This town has been famous for garments and sash, wood products for interior design. It is populated by skilled garments maker and carpenters.

Lately there is a resurgence of progress which are both consumer led - a growing and booming tiangge sites which boast of local and imported products that are cheaper than Divisoria. (A good business for the land owner and Tiangge operators. I studied this business for a while and it is a good and profitable business.

The other is investment led. A number of buildings and factories are going up in a technopark that has been unproductive for the last twenty years.

It is a very good sign.

The upscale subdivision project has not been doing so well.

May resort, pinatayuan ng munisipyo at University. Sana it

works

Consumer led: tiangges

More tiangges sprouting up

Some are taking advantage

scams everywhere

New tiangges sites being built

Parang Bangkok

Rizal Philippines

Novemer 18, 2017

Tanyag Tiangge ng Taytay

for cheap but quality products

Dinadayo ng marami

This town has been famous for garments and sash, wood products for interior design. It is populated by skilled garments maker and carpenters.

Lately there is a resurgence of progress which are both consumer led - a growing and booming tiangge sites which boast of local and imported products that are cheaper than Divisoria. (A good business for the land owner and Tiangge operators. I studied this business for a while and it is a good and profitable business.

The other is investment led. A number of buildings and factories are going up in a technopark that has been unproductive for the last twenty years.

It is a very good sign.

The upscale subdivision project has not been doing so well.

May resort, pinatayuan ng munisipyo at University. Sana it

works

Consumer led: tiangges

More tiangges sprouting up

Some are taking advantage

scams everywhere

New tiangges sites being built

Parang Bangkok

Friday, November 15, 2013

Welcome to the Unicorn club

Techrun - Welcome to the Unicorn club

by Aileen Lee, Founder of Cowboy Ventures

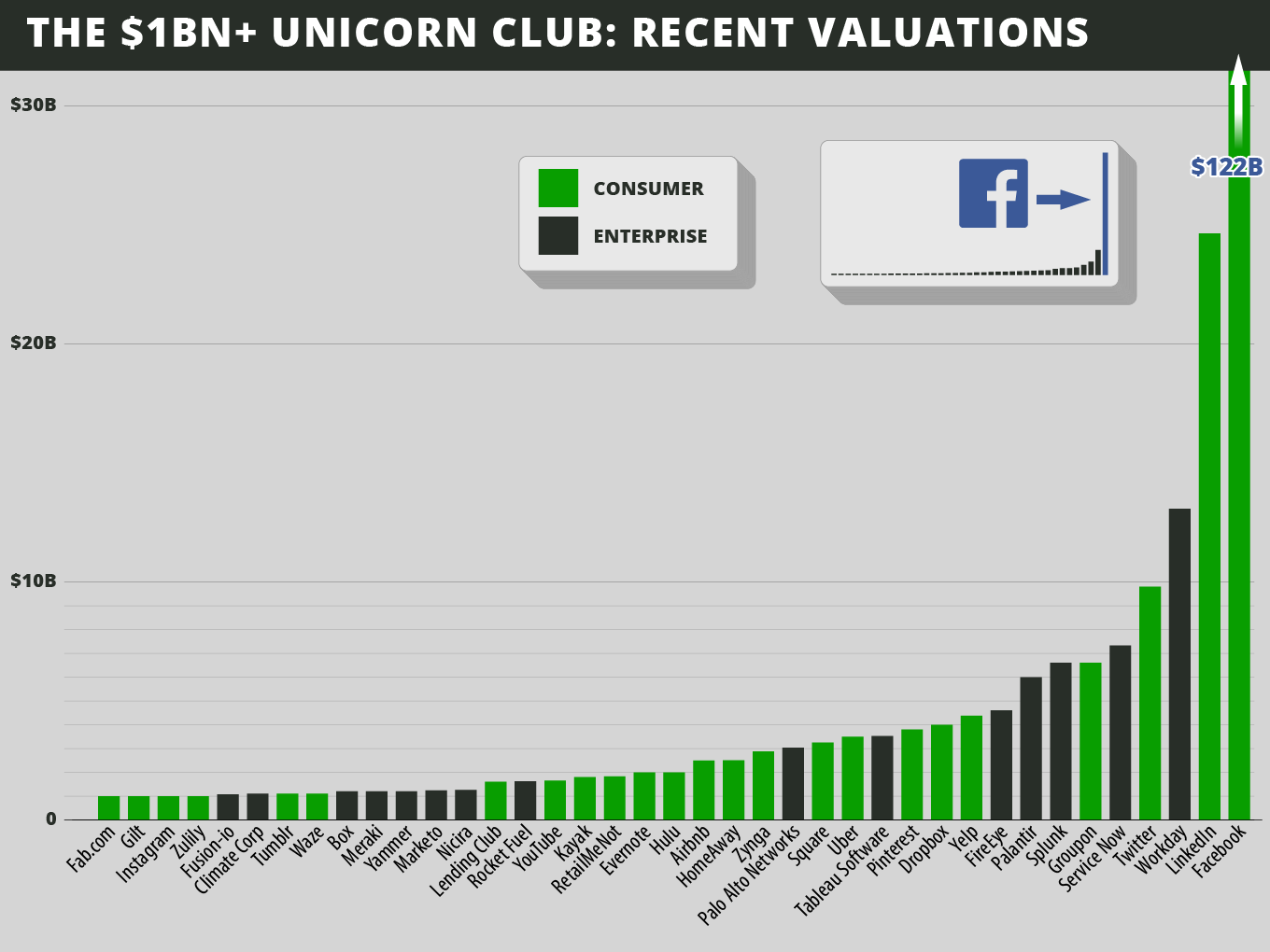

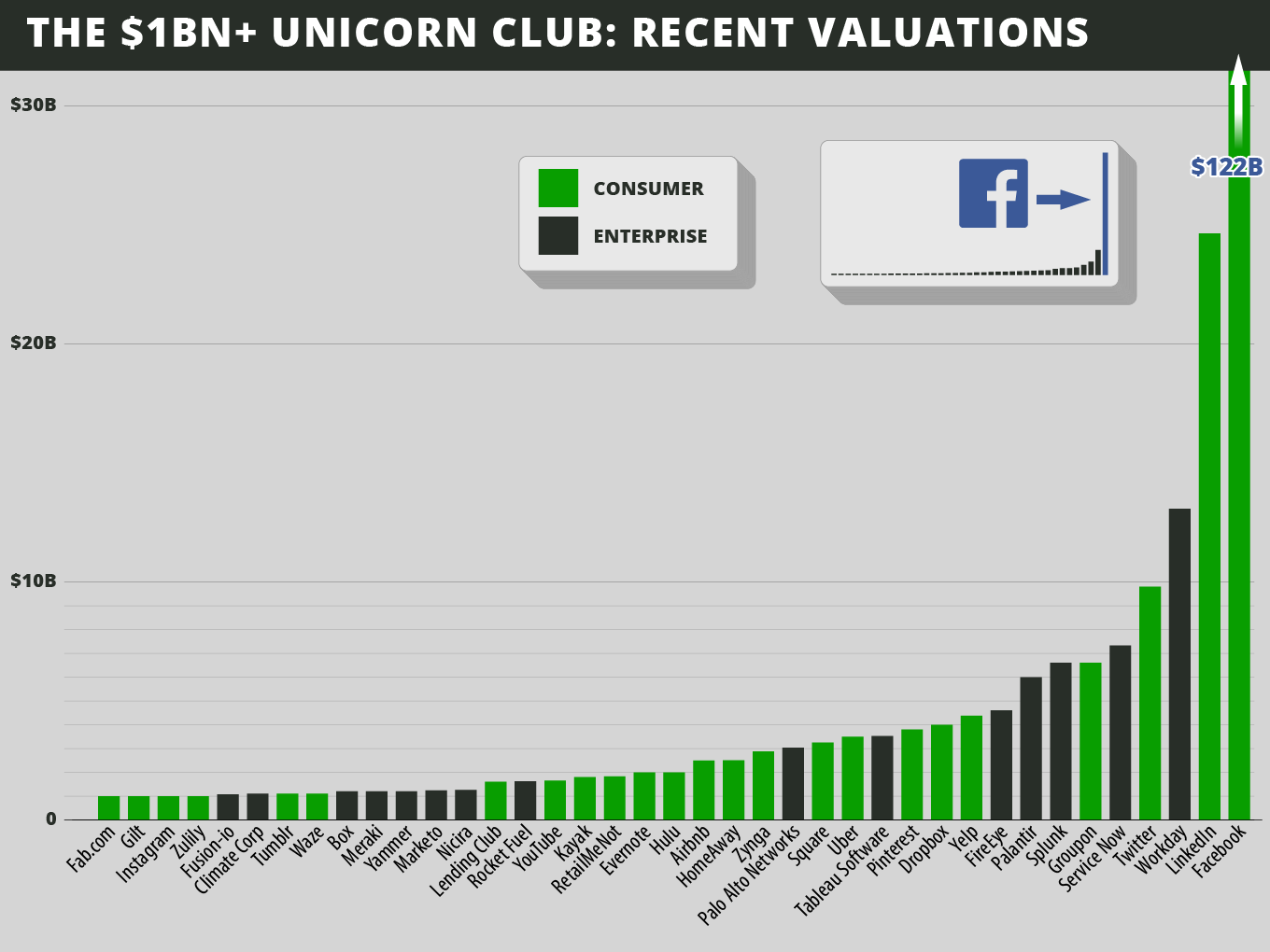

Lee talks about the Unicorn club - the super companies that have been backed by VCs and grown into $ l billion companies. Some of them are: Facebook, Google, Amazon. Most of them are consumer and IT based.

Money is made from the vc backed companies on the exits (ipo, sale of the companies)

Here are more, copied from the article:

--

by Aileen Lee, Founder of Cowboy Ventures

Lee talks about the Unicorn club - the super companies that have been backed by VCs and grown into $ l billion companies. Some of them are: Facebook, Google, Amazon. Most of them are consumer and IT based.

Money is made from the vc backed companies on the exits (ipo, sale of the companies)

Here are more, copied from the article:

Learnings to date about the “Unicorn Club”:

-

We found 39 companies belong to what we call the “Unicorn Club” (by our definition, U.S.-based software companies started since 2003 and valued at over $1 billion by public or private market investors). That’s about .07 percent of venture-backed consumer and enterprise software startups.

-

On average, four unicorns were born per year in the past decade, with Facebook being the breakout “super-unicorn” (worth >$100 billion). In each recent decade, 1-3 super unicorns have been born.

-

Consumer-oriented unicorns have been more plentiful and created more value in aggregate, even excluding Facebook.

-

But enterprise-oriented unicorns have become worth more on average, and raised much less private capital, delivering a higher return on private investment.

-

Companies fall somewhat evenly into four major business models: consumer e-commerce, consumer audience, software-as-a-service, and enterprise software.

-

It has taken seven-plus years on average before a “liquidity event” for companies, not including the third of our list that is still private. It’s a long journey beyond vesting periods.

-

Inexperienced, twentysomething founders were an outlier. Companies with well-educated, thirtysomething co-founders who have history together have built the most successes

-

The “big pivot” after starting with a different initial product is an outlier.

-

San Francisco (not the Valley) now reigns as the home of unicorns.

-

There is very little diversity among founders in the Unicorn Club.

Some deeper explanation and additional findings:

1) Welcome to the exclusive, 39-member Unicorn Club: the Top .07%

-

Figuring out the denominator to unicorn probability is hard. The NVCA says over 16,000 internet-related companies were funded since 2003; Mattermark says 12,291 in the past 2 years; and the CVR says 10-15,000 software companies are seeded each year. So let’s say 60,000 software and internet companies were funded in the past decade. That would mean .07 percent have become unicorns. Or, 1 in every 1,538.

-

Takeaway: it’s really hard, and highly unlikely, to build or invest in a billion dollar company. The tech news may make it seem like there’s a winner being born every minute — but the reality is, the odds are somewhere between catching a foul ball at an MLB game and being struck by lightning in one’s lifetime. Or, more than 100x harder than getting into Stanford.

- That said, these 39 companies have shown it’s possible – and they do offer a lot that can be learned from.

--

Prof Jorge Saguinsin

BIDDA: BELIEVE, INSPIRE, DREAM, DO, ACHIEVE

BIDDA: BELIEVE, INSPIRE, DREAM, DO, ACHIEVE

Subscribe to:

Posts (Atom)