Showing posts with label Quantitative Easing. Show all posts

Showing posts with label Quantitative Easing. Show all posts

Tuesday, July 23, 2019

Dark clouds seen in the financial world that relies too much on credit

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

From Politico Senator Elizabeth Warren warns of impending economic crash

A US Lady Senator Elizabeth Warren has warned Senate and the rest of the world over the weakness of the financial system: too much reliance on debt (even by the Fed) of corporate world and of citizens (via credit card) A little mistake could trigger an avalanche where there could be no escape. Corporate and individual debt via credit cards is at an all time high. To supplant the lack of creation of real wealth at USA (due to over reliance on outsourcing and purchase of manufactured goods made in China) banks have been generous to individuals and corporation.. The Dems complain that the wages have not kept pace with rise in GDP and productivity and hence the gap is filled in by credit...

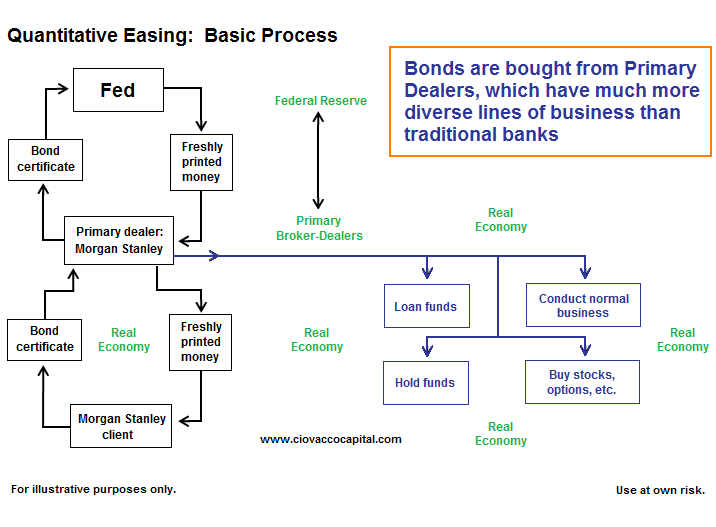

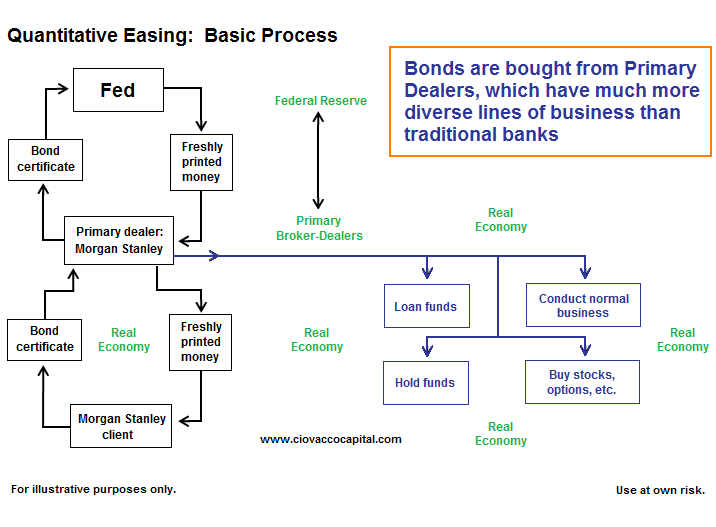

With the quantitative easing in US and Europe (Fed buying bank assets to pump in liquidity to the market) more money supply, more credit is made available to individuals and corporation. Thus more debt, more less stability in financial markets..

Banks have created 97% of the money supply. Not the FED, and this has been uncontrolled.

Rizal Philippines

July 23, 2019

From Politico Senator Elizabeth Warren warns of impending economic crash

A US Lady Senator Elizabeth Warren has warned Senate and the rest of the world over the weakness of the financial system: too much reliance on debt (even by the Fed) of corporate world and of citizens (via credit card) A little mistake could trigger an avalanche where there could be no escape. Corporate and individual debt via credit cards is at an all time high. To supplant the lack of creation of real wealth at USA (due to over reliance on outsourcing and purchase of manufactured goods made in China) banks have been generous to individuals and corporation.. The Dems complain that the wages have not kept pace with rise in GDP and productivity and hence the gap is filled in by credit...

With the quantitative easing in US and Europe (Fed buying bank assets to pump in liquidity to the market) more money supply, more credit is made available to individuals and corporation. Thus more debt, more less stability in financial markets..

Banks have created 97% of the money supply. Not the FED, and this has been uncontrolled.

Thursday, January 17, 2013

Fed President: More QE Probably Needed Into Second Half of 2013

More money into circulation? More dollars to flood the market?

When PHL was in trouble, the prescription was less money supply to rein in money supply. More taxes, less spending, less budget by public to pay off foreign debt. It was a bitter medicine. Hence there were lots of demonstration, lots of anti imperialist slogans, stone throwing, anti US hatred and anti IMF tirades.

For USA though, it a lot of stimulus package, quantitative easing. Is it working?

For the PHL the tight and disciplined fiscal policy worked. Why can IMF, US Fed Bank impose the same for USA?

Or a different strategy and rules apply for the LDC and developed countries?

--

Jorge U. Saguinsin

To "be the best, do your best, expect the best" always

When PHL was in trouble, the prescription was less money supply to rein in money supply. More taxes, less spending, less budget by public to pay off foreign debt. It was a bitter medicine. Hence there were lots of demonstration, lots of anti imperialist slogans, stone throwing, anti US hatred and anti IMF tirades.

For USA though, it a lot of stimulus package, quantitative easing. Is it working?

For the PHL the tight and disciplined fiscal policy worked. Why can IMF, US Fed Bank impose the same for USA?

Or a different strategy and rules apply for the LDC and developed countries?

---------- Forwarded message ----------

From: Moneynews.com <newsmax@reply.newsmax.com>

Date: Tue, Jan 15, 2013 at 5:09 AM

Subject: Fed President: More QE Probably Needed Into Second Half of 2013

From: Moneynews.com <newsmax@reply.newsmax.com>

Date: Tue, Jan 15, 2013 at 5:09 AM

Subject: Fed President: More QE Probably Needed Into Second Half of 2013

|

--

Jorge U. Saguinsin

To "be the best, do your best, expect the best" always

Monday, September 17, 2012

The US stock rally will end terribly.

Ateneo Professor on Entrepreneurship

From Moneynews

Jim Rogers, a noted international investor has noted that the rising stock prices are due for a massive sell off. The rise in prices has not been rooted in sound fundamentals. The loose monetary policy of US Fed is the sole driver of Wall St. stock prices.

Since 2008 the US Fed has kept interest rates to almost 0 and kept liquidity high allegedly to encourage investments and create jobs.

Is this strategy right?

Are QEs implemented so far producing the desired results for US economy

From Moneynews

Jim Rogers, a noted international investor has noted that the rising stock prices are due for a massive sell off. The rise in prices has not been rooted in sound fundamentals. The loose monetary policy of US Fed is the sole driver of Wall St. stock prices.

Since 2008 the US Fed has kept interest rates to almost 0 and kept liquidity high allegedly to encourage investments and create jobs.

Is this strategy right?

Are QEs implemented so far producing the desired results for US economy

Sunday, September 16, 2012

Is Quantitative Easing (QE) - Liquidity Infusion good for the US economy?

Ateneo Professor on Entrepreneurship

From Moneynews

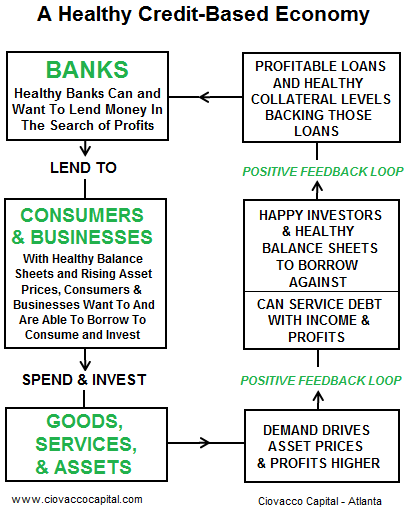

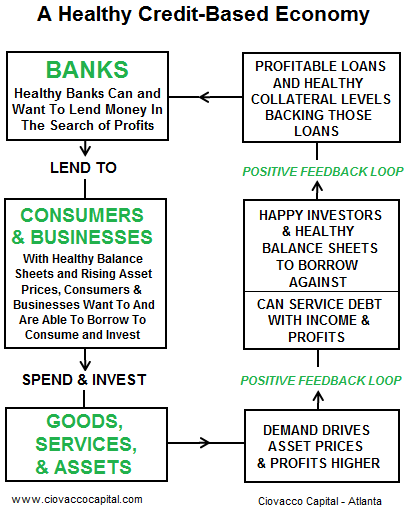

Is the Quantitative Easing (US Fed printing money, buying back bonds and treasuries) in effect injecting liquidity into the financial system, good for the US economy?

Donald Trump, a real estate mogul and now an outspoken US citizen thinks QE is giving the stock market false results.

Home buyers are not buying new homes, despite the added liquidity, because banks are not lending anyway. Where is the excess liquidity going into? Foreign investments? Or stock market (maybe offshore) and does not go to intended beneficiary.

Past QE injected $2.3 trillion into the economy: QE 1 Fed bought $1.7 trillion of mortgage backed securities from banks; under QE 2 $600 billion worth of Treasury holdings were bought. Under QE 3, $40 billion worth of securities would be bought monthly from banks to generate more jobs. That extra liquidity, $2.3 trillion is increasing and will increase further. (Many think that gold is at $l,600 per ounce because it has now been the more acceptable currency and no longer the dollar; the dollar has lost its value because of this excessive liquidity )

These moves ie injecting liquidity into the market was done to avert depression; however many think that the amount of infusion is too large and depresses the value of the dollar, and that much of this has been going into welfare like food stamps where 44 million Americans are enrolled. Are they looking for jobs in a jobless economy.

Money News on Trump - Fed causing stock market to give false numbers

From Moneynews

Is the Quantitative Easing (US Fed printing money, buying back bonds and treasuries) in effect injecting liquidity into the financial system, good for the US economy?

Donald Trump, a real estate mogul and now an outspoken US citizen thinks QE is giving the stock market false results.

Home buyers are not buying new homes, despite the added liquidity, because banks are not lending anyway. Where is the excess liquidity going into? Foreign investments? Or stock market (maybe offshore) and does not go to intended beneficiary.

Past QE injected $2.3 trillion into the economy: QE 1 Fed bought $1.7 trillion of mortgage backed securities from banks; under QE 2 $600 billion worth of Treasury holdings were bought. Under QE 3, $40 billion worth of securities would be bought monthly from banks to generate more jobs. That extra liquidity, $2.3 trillion is increasing and will increase further. (Many think that gold is at $l,600 per ounce because it has now been the more acceptable currency and no longer the dollar; the dollar has lost its value because of this excessive liquidity )

These moves ie injecting liquidity into the market was done to avert depression; however many think that the amount of infusion is too large and depresses the value of the dollar, and that much of this has been going into welfare like food stamps where 44 million Americans are enrolled. Are they looking for jobs in a jobless economy.

Money News on Trump - Fed causing stock market to give false numbers

Subscribe to:

Posts (Atom)