From Moneynews

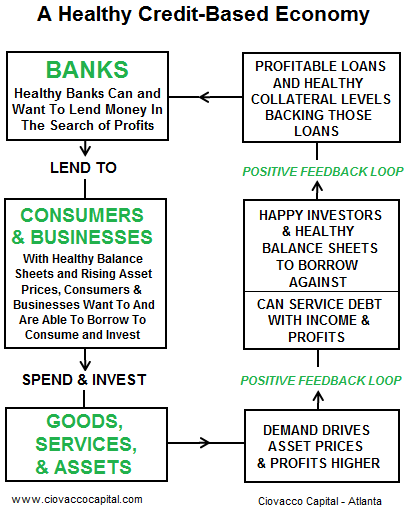

Jim Rogers, a noted international investor has noted that the rising stock prices are due for a massive sell off. The rise in prices has not been rooted in sound fundamentals. The loose monetary policy of US Fed is the sole driver of Wall St. stock prices.

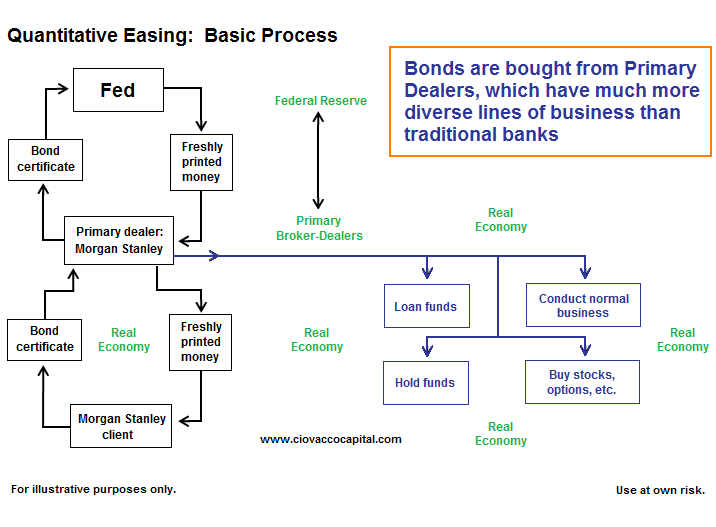

Since 2008 the US Fed has kept interest rates to almost 0 and kept liquidity high allegedly to encourage investments and create jobs.

Is this strategy right?

Are QEs implemented so far producing the desired results for US economy

I would really like your post ,it would really explain each and every point clearly well thanks for sharing.

ReplyDeleteRegards,

seo company melbourne