From Fox News | October 15, 2013

From Washington Post workblog

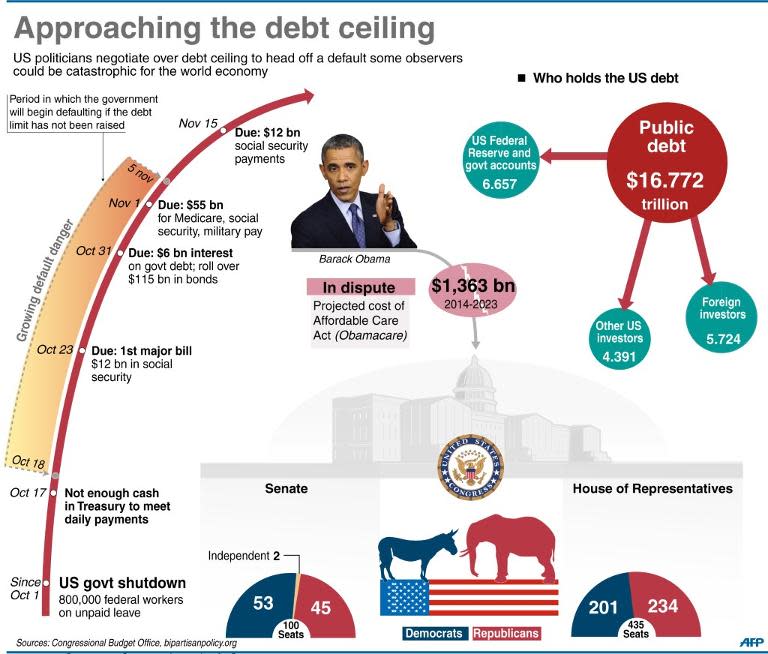

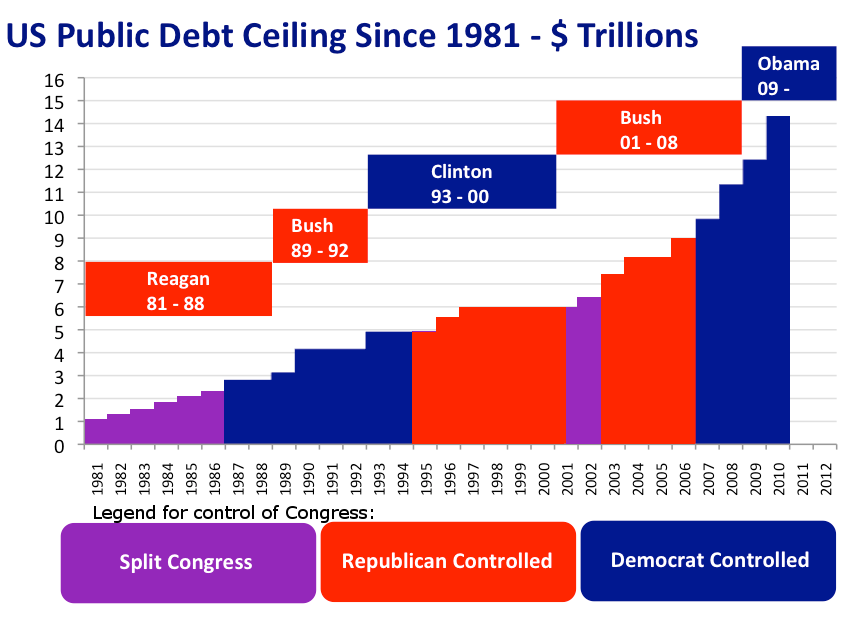

The Republicans abruptly cancelled plans on vote on budget, apparently lacking the votes, and now focus on bipartisan negotiations that would have spending budget through December l5 and borrowing till February 7. The negotiation is now between democratic leader in the Senate Henry Reid and his counterpart Sen Mitch McConnel. (The house is controlled by Republicans and the Senate by Democrats, hence the deadlock. The agreement would not cover the tax on medical device and funding for the Obamacare.

As this is happenning, one the 3 rating agencies Fitch warned of possible downgrade of US Treasuries from 3A.( From Huffington Post | October 15, 2013)

Payables of US Govt needing funds from additional borrowings: