Ateneo Professor on Entrepreneurship

Many of us wonder why despite the best minds and analysis, change doesnt happen or many proposals gather dust at the archive. "Ideas are fine but execution is a bitch."

I like this mindset, breakthrough thinking because it best fits the entrepreneurship mold. This deals with things that are not or has not been, but of of things that will be.

I posted this in our internal blog of the company because change and achievements are our big problems.

"Breakthrough Thinking PDF

This

morning, we talked at the third floor about our inability to reach our

targets - inability to reach breakthrough our barriers. I discussed

with them the principles espoused by Prof Hibino at breakthrough thinking.

There are seven principles:

1. Systems principle

2. Uniqueness principle

3. People design

4. Limited information principle

5. Solution after next

6. Betterment timeline

7. Purpose

This

is a better approach especially in designing the future. We normally

design the future based on the past. There is no basis for predicating

the past based on history. History has been marred by discontinuities

and disruptions, if not breakthrough. This way of thinking is fitted

for entrepreneurs who think of things that are not yet there and ask

"Why not?""

Author - semi retired business entrepreneur leader who is now a senior citizen. Current posts are about his current business experience and learnings. A former lecturer at a top GSB in the PHL for more than a decade. We had great successful entrepreneur graduates

Saturday, September 28, 2013

Thursday, September 26, 2013

Asia Pacific rich set to outpace US counterpart

Ateneo Professor on Entrepreneurship

Repost from South China Morning Post Economy | September 26, 2013

The rich and famous in the Asia Pacific region would outpace the North American counterparts. The crown was taken last year from AP after the growth of equity markets in North America. North American networth stands at $12.7 trillion vs Asia Pacific which stands at 12.0 trillion.

Asia has 3.68 million high networth individuals vs North America's 3.73 million. The growth of networth of Asian rich would grow by 9.8% surpassing the networth of Americans. AP networth would be $15.9 vs $15 million of North America. This has something to do with GDP growth which is an average 6.6 for this year and 6.8 for next. For America this only 2.5 and 3.2% next year.

Asians seek more real estate as investments. And have different investment preferences compared to Americans

From Financial News

Repost from South China Morning Post Economy | September 26, 2013

The rich and famous in the Asia Pacific region would outpace the North American counterparts. The crown was taken last year from AP after the growth of equity markets in North America. North American networth stands at $12.7 trillion vs Asia Pacific which stands at 12.0 trillion.

Asia has 3.68 million high networth individuals vs North America's 3.73 million. The growth of networth of Asian rich would grow by 9.8% surpassing the networth of Americans. AP networth would be $15.9 vs $15 million of North America. This has something to do with GDP growth which is an average 6.6 for this year and 6.8 for next. For America this only 2.5 and 3.2% next year.

Asians seek more real estate as investments. And have different investment preferences compared to Americans

From Financial News

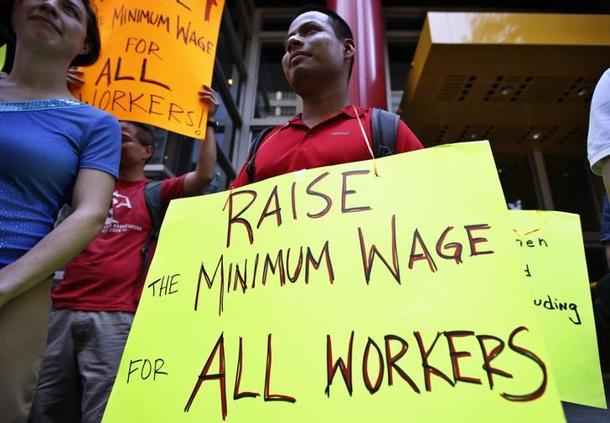

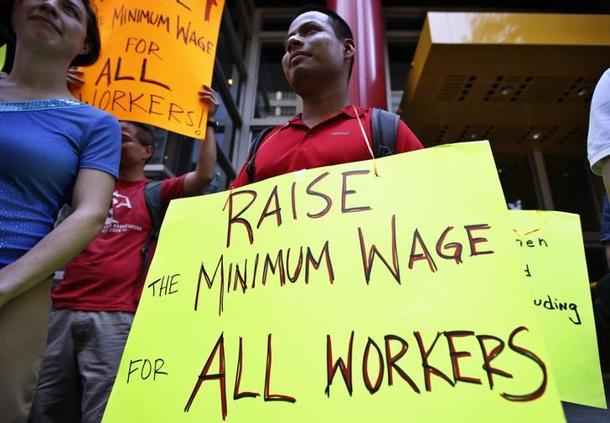

California raises minimum wage to $10 per hour; is this making California uncompetitive? Is California still the USA dreamland? s

Ateneo Professor on Entrepreneurship

Repost from Reuters | September 25, 2013

Gov Jerry Brown signed into a law a bill that seeks to increase the minimum age of Californians to $10 per hour till 2016 up from present $8.00 per hour. That would be increase of $16 per day or about P600.00 per day or more than our minimum age in the PHL. This is seen as a move to help California residents keep up with the rising cost of living. The clamor for higher wages in California seems to be on the rise, as photos below would show. The move is supported by Democrats who are pro poor and pro labor. Republicans said however that it would hurt entrepreneurs and small businessmen

However, this would make California more uncompetitive, reduce job opportunities, and cause many residents to seek employment elsewhere. That is the law of investment and opportunity seeking.

I had advised a PHL food processor not to put up a manufacturing base in USA two years ago; at that time, cost of doing business in California was all ready very stiff and steep. This is not to mention the cost of litigation and regulations in California

This would help fuel more outsourcing because it is cheaper to outsource abroad.

California no longer a nice place for start ups?

Would this be helpful to California in the long run?

Would you support this bill if you were a public sector leader?

Repost from Reuters | September 25, 2013

Gov Jerry Brown signed into a law a bill that seeks to increase the minimum age of Californians to $10 per hour till 2016 up from present $8.00 per hour. That would be increase of $16 per day or about P600.00 per day or more than our minimum age in the PHL. This is seen as a move to help California residents keep up with the rising cost of living. The clamor for higher wages in California seems to be on the rise, as photos below would show. The move is supported by Democrats who are pro poor and pro labor. Republicans said however that it would hurt entrepreneurs and small businessmen

However, this would make California more uncompetitive, reduce job opportunities, and cause many residents to seek employment elsewhere. That is the law of investment and opportunity seeking.

I had advised a PHL food processor not to put up a manufacturing base in USA two years ago; at that time, cost of doing business in California was all ready very stiff and steep. This is not to mention the cost of litigation and regulations in California

This would help fuel more outsourcing because it is cheaper to outsource abroad.

California no longer a nice place for start ups?

Would this be helpful to California in the long run?

Would you support this bill if you were a public sector leader?

Wednesday, September 25, 2013

Eurozone on the way to recovery (or simply because Chancellor was reelected)?

Ateneo Professor on Entrepreneurship

The German Channel D W yesterday announced that Eurozone is on the way to recovery. However, all that was featured were scenes from Germany: the forthcoming Octoberfest and Germans in the major cities. Of course, the face of the German Chancellor Merkel who was reelected was shown. Maybe the reelection sent signals of stability and continued support of Germany to the Euro and the Eurozone. That is how much leadership can send calming effect on markets and economy.

That news, although somewhat a PR news and overly positive was certainly made to put positive note on the economy and inspire the rest of Europe

The German Channel D W yesterday announced that Eurozone is on the way to recovery. However, all that was featured were scenes from Germany: the forthcoming Octoberfest and Germans in the major cities. Of course, the face of the German Chancellor Merkel who was reelected was shown. Maybe the reelection sent signals of stability and continued support of Germany to the Euro and the Eurozone. That is how much leadership can send calming effect on markets and economy.

That news, although somewhat a PR news and overly positive was certainly made to put positive note on the economy and inspire the rest of Europe

Is the debt ceiling increase for US sending shock waves to the World Capital Markets?

Ateneo Professor on Entrepreneurship

Many newsrooms are flashing with declining share prices in major capital markets, supposedly on concern over the debt limit issue at the US. This has been increased to $16+ trillion last August 2011, and this limit will be breached soon (this October) The US Secy of Treasury (and the Pres) has been pushing Congress to pass the law.

Many foresee the repeat of partisan politics which prevented the early passage of this law in 2011. As a result US debt was downgraded

The current debate for the debt limit however is sending many share prices world wide on downward slide. The US is still seen as the center for innovation, leadership, and financial strength. The US dollar is still as the currency of choice for trade and Central Bank Reserves The US debt level, and the political uncertainty casts doubt on that perception.

I hope this issue is resolved soon.

Will this problem pose further threat on the US dollar and world capital markets?

Many newsrooms are flashing with declining share prices in major capital markets, supposedly on concern over the debt limit issue at the US. This has been increased to $16+ trillion last August 2011, and this limit will be breached soon (this October) The US Secy of Treasury (and the Pres) has been pushing Congress to pass the law.

Many foresee the repeat of partisan politics which prevented the early passage of this law in 2011. As a result US debt was downgraded

The current debate for the debt limit however is sending many share prices world wide on downward slide. The US is still seen as the center for innovation, leadership, and financial strength. The US dollar is still as the currency of choice for trade and Central Bank Reserves The US debt level, and the political uncertainty casts doubt on that perception.

I hope this issue is resolved soon.

Will this problem pose further threat on the US dollar and world capital markets?

Investors Relocating Again to the Phil in Droves - Gunigundo of BSP

Ateneo Professor on Entrepreneurship

Deputy Governor of BSP Diwa Gunigundo announced at a PTV program/interview that many investors who have relocated to China are going back to the PHL. Many realized their mistake by relocating to China. One such example is FEDEX. FEDEX I heard relocated to China because of: proximity to the market/shippers, and lower cost. However, they had horrendous difficulties with the language barrier and work habits of Chinese workers. I heard that they are going to the PHL but this time at Clark.

The good deputy governor said that the cost advantage of Chinese labor has been negated by now higher wages. The PHL workers understand English; you do not need English manuals and thus are more efficient and productive.

In so far as Thailand and Japanese manufacturers are concerned; I heard that many of them would want to relocate to the PHL because of the floods.

Is this for real?

Deputy Governor of BSP Diwa Gunigundo announced at a PTV program/interview that many investors who have relocated to China are going back to the PHL. Many realized their mistake by relocating to China. One such example is FEDEX. FEDEX I heard relocated to China because of: proximity to the market/shippers, and lower cost. However, they had horrendous difficulties with the language barrier and work habits of Chinese workers. I heard that they are going to the PHL but this time at Clark.

The good deputy governor said that the cost advantage of Chinese labor has been negated by now higher wages. The PHL workers understand English; you do not need English manuals and thus are more efficient and productive.

In so far as Thailand and Japanese manufacturers are concerned; I heard that many of them would want to relocate to the PHL because of the floods.

Is this for real?

Sunday, September 15, 2013

Japan's economy in bad shape?

Ateneo Professor on Entrepreneurship

Repost from About.com | August 28, 2013

Despite our impression that the Japan's economic juggernaut is still on the move (what with the Toyota, Mitsubishi, National, Fuji, Nissan, JVC and more dominating their markets) Japan's economy is in bad shape even before the the 2011 tsunami disaster and Fukushima nuclear power plant problems, economic problems have hobbled Japan since 2008. I got a hint of this when IMF chief in a BBC interview said that Japan is a challenge to them.

I used to admire and absorb all things that are Japanese - management, manufacturing methods, quality etc.

Japan's debt to GDP ratio is 182% (nearly twice) which more than the US. Unlike US which has dealt agressively with its economic woes (like the QE), Japan is not.

Some economic data on Japan:

1. Japan's economy shrank .11% in 2011 due to decline in manufacturing output due to lesser electricity generation due to Fukushima problem;

2. The bank of Japan bought US bonds heavily to make yen competitive, hence the high debt to GDP ratio;

3. Japan just emerged from a 20 year period of deflation and recession;

4. It has aging population;

5. It is challenged by rising commodity prices: it has to import much of its food and fuel resources;

Above all, Japan is behind now in entrepreneurship.

Japan as the 4th largest world economy is important to rest of Asian countries as it provides many jobs. It establishes plants and supply chain for its manufacturing sector for the car and electronics. And there is the competition from China.

Do you agree with the statement that Japan's economy (and finances) is in trouble?

What could the Japanese government do to reverse the situation?

Is entrepreneurship really a problem in Japan?

So Japayukis and those working for Japanese companies, this not the time to be complacent. Japan's economy is not so sound as we think it is

Repost from About.com | August 28, 2013

Despite our impression that the Japan's economic juggernaut is still on the move (what with the Toyota, Mitsubishi, National, Fuji, Nissan, JVC and more dominating their markets) Japan's economy is in bad shape even before the the 2011 tsunami disaster and Fukushima nuclear power plant problems, economic problems have hobbled Japan since 2008. I got a hint of this when IMF chief in a BBC interview said that Japan is a challenge to them.

I used to admire and absorb all things that are Japanese - management, manufacturing methods, quality etc.

Japan's debt to GDP ratio is 182% (nearly twice) which more than the US. Unlike US which has dealt agressively with its economic woes (like the QE), Japan is not.

Some economic data on Japan:

1. Japan's economy shrank .11% in 2011 due to decline in manufacturing output due to lesser electricity generation due to Fukushima problem;

2. The bank of Japan bought US bonds heavily to make yen competitive, hence the high debt to GDP ratio;

3. Japan just emerged from a 20 year period of deflation and recession;

4. It has aging population;

5. It is challenged by rising commodity prices: it has to import much of its food and fuel resources;

Above all, Japan is behind now in entrepreneurship.

Japan as the 4th largest world economy is important to rest of Asian countries as it provides many jobs. It establishes plants and supply chain for its manufacturing sector for the car and electronics. And there is the competition from China.

Do you agree with the statement that Japan's economy (and finances) is in trouble?

What could the Japanese government do to reverse the situation?

Is entrepreneurship really a problem in Japan?

So Japayukis and those working for Japanese companies, this not the time to be complacent. Japan's economy is not so sound as we think it is

Thursday, September 12, 2013

Is profit maximization the only goal of business? Can we have lower cost health care?

Ateneo Professor on Entrepreneurship

Repost from cheapcures; why are health care costs so high?

We have been often told that the goal of business is profit maximization. We have been told also by management guru Peter Drucker that business is an entity that creates customer. Thus satisfying the needs and wants of customer, and making them aware, enticing them to buy and use our products should be the primary goal of business. Profit is not the primary goal but that is just a performance indicator of our success in satisfying the customer.

Besides there are other performance indicators (objectives) of business: job generation, customer impact, sales, and financials and profit is just one of the financial objectives.

In US (and also in the PHL) the pharmas and the hospitals are often criticized to be very greedy and very much in the way of profit maximization. In the US, health care costs are high but longevity of people is at the tail end. US spends 10x as much as other developed countries in the world.

We see this trend also beginning in the PHL/

How can we help the other teeming masses of Filipinos who wont see an MD in their lifetime.An herbolario or hilot maybe? Maybe we can have hilots and herbolarios as another avenue for wellness?

Or use the Dr. Devi Shetty of India model in Western Hospital Care?

Repost from cheapcures; why are health care costs so high?

We have been often told that the goal of business is profit maximization. We have been told also by management guru Peter Drucker that business is an entity that creates customer. Thus satisfying the needs and wants of customer, and making them aware, enticing them to buy and use our products should be the primary goal of business. Profit is not the primary goal but that is just a performance indicator of our success in satisfying the customer.

Besides there are other performance indicators (objectives) of business: job generation, customer impact, sales, and financials and profit is just one of the financial objectives.

In US (and also in the PHL) the pharmas and the hospitals are often criticized to be very greedy and very much in the way of profit maximization. In the US, health care costs are high but longevity of people is at the tail end. US spends 10x as much as other developed countries in the world.

We see this trend also beginning in the PHL/

How can we help the other teeming masses of Filipinos who wont see an MD in their lifetime.An herbolario or hilot maybe? Maybe we can have hilots and herbolarios as another avenue for wellness?

Or use the Dr. Devi Shetty of India model in Western Hospital Care?

Wednesday, September 11, 2013

Are you where you want to be professionally?

Another forum discussion from Linked involving Harvard Business School. Make your contributions or join the discussion

Are you happy with your career? Have you achieved your career objectives?

Would you like owning a condo near UST/University belt

From: Harvard Business Review Group Members <group-digests@linkedin.com>

Date: Sat, Sep 7, 2013 at 12:42 AM

Subject: Are you where you want to be professionally?

--

Are you happy with your career? Have you achieved your career objectives?

Would you like owning a condo near UST/University belt

From: Harvard Business Review Group Members <group-digests@linkedin.com>

Date: Sat, Sep 7, 2013 at 12:42 AM

Subject: Are you where you want to be professionally?

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

--

Tuesday, September 10, 2013

Another protest rally by jeepney drivers vs gasoline price increase?

Ateneo Professor on Entrepreneurship

Philippines | September 10, 2013

Another round of gasoline price increases has been announced for this week by the major oil companies. And in the offing are announced strikes protest by radical transport groups. Another day of work stoppage which adds nothing to anyone. The jeepney drivers protest action does not endear anymore to anyone for misdirected and useless efforts. They simply shoot themselves and that of their customers (the riding public)

Some clarifications:

1. The government nor the oil refineries/producers have nothing to do with increases in oil price. Geopolitics and the oil producers (OPEC) control the price of oil world wide.

2. The Syrian and Egyptian conflict make the world market for oil nervous; they are in the Middle East and controls the Gulf where the oil tankers ply their routes. The planned military action by US vs Syria (to which Russia objects) can send the world on brink of bigger war which makes the oil traders even more nervous. There is speculation/hoarding which spikes oil prices and we expect more.

Rather than resort to protest (which does not promote world peace!!!) some actions are suggested;

l. Make the vehicles more fuel efficient or buy new units so that there could be more passengers and more revenues. The jeepney drivers and operators that new modern AC buses and FX vans are taking away their business;

2. Resort to alternative energy sources: EV, hybrids and more.

High oil prices are here to stay; let us not cry and be angry. Let us be realistic and adjust as a mature human being/citizen would

Philippines | September 10, 2013

Another round of gasoline price increases has been announced for this week by the major oil companies. And in the offing are announced strikes protest by radical transport groups. Another day of work stoppage which adds nothing to anyone. The jeepney drivers protest action does not endear anymore to anyone for misdirected and useless efforts. They simply shoot themselves and that of their customers (the riding public)

Some clarifications:

1. The government nor the oil refineries/producers have nothing to do with increases in oil price. Geopolitics and the oil producers (OPEC) control the price of oil world wide.

2. The Syrian and Egyptian conflict make the world market for oil nervous; they are in the Middle East and controls the Gulf where the oil tankers ply their routes. The planned military action by US vs Syria (to which Russia objects) can send the world on brink of bigger war which makes the oil traders even more nervous. There is speculation/hoarding which spikes oil prices and we expect more.

Rather than resort to protest (which does not promote world peace!!!) some actions are suggested;

l. Make the vehicles more fuel efficient or buy new units so that there could be more passengers and more revenues. The jeepney drivers and operators that new modern AC buses and FX vans are taking away their business;

2. Resort to alternative energy sources: EV, hybrids and more.

High oil prices are here to stay; let us not cry and be angry. Let us be realistic and adjust as a mature human being/citizen would

Saturday, September 7, 2013

How to get a community of loyal customers?

Ateneo Professor on Entrepreneurship

Repost from Inc by Les Mckeown | September 4, 2013

Fierce loyalty is an idea that comes from the recent book of the same title by Sarah Robinson. Great customer service is essential to fierce loyalty. It is not only possible but is necessary to build customer loyalty in this very competitive environment.

Example of fiercely loyal customers are buyers of Harley Davidson motorcycles: they have decals, clubs, t shirts and caps which demonstrate fierce loyalty to the brand.

Home away from home at University belt

This requires deep commitment, first and foremost from the organization so that in return, the customers become fiercely loyal.

What are the benefits of fierce loyalty to the business:

1. Empowered evangelists (apostles)

2. Grass root R & D;

3. Hunger customer base

4. Lower customer attrition (leaving and abandoning your product)

5. Happier customer

Repost from Inc by Les Mckeown | September 4, 2013

Fierce loyalty is an idea that comes from the recent book of the same title by Sarah Robinson. Great customer service is essential to fierce loyalty. It is not only possible but is necessary to build customer loyalty in this very competitive environment.

Example of fiercely loyal customers are buyers of Harley Davidson motorcycles: they have decals, clubs, t shirts and caps which demonstrate fierce loyalty to the brand.

Home away from home at University belt

This requires deep commitment, first and foremost from the organization so that in return, the customers become fiercely loyal.

What are the benefits of fierce loyalty to the business:

1. Empowered evangelists (apostles)

2. Grass root R & D;

3. Hunger customer base

4. Lower customer attrition (leaving and abandoning your product)

5. Happier customer

Monday, September 2, 2013

Old School Strategy is Dead - Slideshare presentatiion

Ateneo Professor on Entrepreneurship

September 2, 2013

Earlier, I made a post on the said subject matter. Old School Strategy is dead at ProJorge blog

I made a slideshare presentation for sharing and easy lecture. Please view:

September 2, 2013

Earlier, I made a post on the said subject matter. Old School Strategy is dead at ProJorge blog

I made a slideshare presentation for sharing and easy lecture. Please view:

Sunday, September 1, 2013

Will I finally have Spentrep classes tomorrow?

Ateneo Professor on Entrepreneurship

September 1, 2013

Tomorrow September 2, is class day, Monday for Spentrep elective. The classes were suspended twice: Aug 12, and Aug l9 because of flooding due to typhoon. And last August 26 there were no classes again because of a holiday.

I e mailed the students (based on the list given to me by the academic coordinator) so that we can be more productive and efficient by giving them advance instructions on the syllabus and assignments

I hope to have classes tomorrow - finally and get on with it.

If you have children at UST you can try owning/renting here and avoid wading through the floods

September 1, 2013

Tomorrow September 2, is class day, Monday for Spentrep elective. The classes were suspended twice: Aug 12, and Aug l9 because of flooding due to typhoon. And last August 26 there were no classes again because of a holiday.

I e mailed the students (based on the list given to me by the academic coordinator) so that we can be more productive and efficient by giving them advance instructions on the syllabus and assignments

I hope to have classes tomorrow - finally and get on with it.

If you have children at UST you can try owning/renting here and avoid wading through the floods

Subscribe to:

Comments (Atom)