Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

A former dean commented on my recent post that those business that cater to basic needs are not necessarily patok or stable. He discounted real estate because of the real estate crisis (debacle of 1997 due to subprime mortgages due to sins of investment bankers, bankers and their cahoots)

There are downsides to realty or subdivsion development. 1. It is a one shot deal. After the development and sale of Lot or House and Lot units, the business stops unless there is water system, or leasing of commercial units, or parking in the case of Ayala. So next time you develop, be sure you have units for leasing so that you have recurring income 2. You have to keep on looking for land and land is scarce and therefore prices spiral up. Land which were P20.00 before are now P2,000 per square meter.

I like the current business now memorial parks, there are recurring revenues afterwards: interment, funeral service memorial plans... On a single lot, you can have two interments, two funeral service and even more memorial plans

Author - semi retired business entrepreneur leader who is now a senior citizen. Current posts are about his current business experience and learnings. A former lecturer at a top GSB in the PHL for more than a decade. We had great successful entrepreneur graduates

Tuesday, July 23, 2019

Dark clouds seen in the financial world that relies too much on credit

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

From Politico Senator Elizabeth Warren warns of impending economic crash

A US Lady Senator Elizabeth Warren has warned Senate and the rest of the world over the weakness of the financial system: too much reliance on debt (even by the Fed) of corporate world and of citizens (via credit card) A little mistake could trigger an avalanche where there could be no escape. Corporate and individual debt via credit cards is at an all time high. To supplant the lack of creation of real wealth at USA (due to over reliance on outsourcing and purchase of manufactured goods made in China) banks have been generous to individuals and corporation.. The Dems complain that the wages have not kept pace with rise in GDP and productivity and hence the gap is filled in by credit...

With the quantitative easing in US and Europe (Fed buying bank assets to pump in liquidity to the market) more money supply, more credit is made available to individuals and corporation. Thus more debt, more less stability in financial markets..

Banks have created 97% of the money supply. Not the FED, and this has been uncontrolled.

Rizal Philippines

July 23, 2019

From Politico Senator Elizabeth Warren warns of impending economic crash

A US Lady Senator Elizabeth Warren has warned Senate and the rest of the world over the weakness of the financial system: too much reliance on debt (even by the Fed) of corporate world and of citizens (via credit card) A little mistake could trigger an avalanche where there could be no escape. Corporate and individual debt via credit cards is at an all time high. To supplant the lack of creation of real wealth at USA (due to over reliance on outsourcing and purchase of manufactured goods made in China) banks have been generous to individuals and corporation.. The Dems complain that the wages have not kept pace with rise in GDP and productivity and hence the gap is filled in by credit...

With the quantitative easing in US and Europe (Fed buying bank assets to pump in liquidity to the market) more money supply, more credit is made available to individuals and corporation. Thus more debt, more less stability in financial markets..

Banks have created 97% of the money supply. Not the FED, and this has been uncontrolled.

Savings and frugality are the foundation of capital and money markets

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

There could be no market or capital markets unless there was frugality and savings. The money that flows in and out of capital and financial markets are results of thrift and savings. The millenials are less likely to save now.

Good old savings of money makes the world go round...

Save. Reduce cost and expenses...

Rizal Philippines

July 23, 2019

There could be no market or capital markets unless there was frugality and savings. The money that flows in and out of capital and financial markets are results of thrift and savings. The millenials are less likely to save now.

Good old savings of money makes the world go round...

Save. Reduce cost and expenses...

Leveraging and OPM - that is the magic and what real estate deals are all about...

Ateneo Professor on Entrepreneurship

Rizal Philippines

History of Meralco

The real real estate deals are those where little or none of your money is used. And only brilliant deal makers entrepreneurs can do that.

Examples.

1. Purchase of Lopez from GTU of Meralco...

Under the Laurel Langley agreement, all US owned companies in the Phil by 19.., they shall be sold and transferred to Philippine owners, especially the utility firms like Meralco, Channel 7.

Classic was the purchase of Meralco by Lopezes from GTU

1. Lopez using personal money makes a DP; Lopez borrows from PCIBank

2. Lopez executes a Contract for term payment of Meralco (which could probably come from

earnings,) say 10 years

3. Lopez incorporates a holding company to hold the Meralco shares, keeping corporate structure

of Meralco intact: Meralco Securities Lopez of course are the majority stockholders

4. Meralco floats some of the shares at an IPO. The proceeds are used to pay off the PCIBank

loan.

Question: did Lopez use his own money to buy Meralco..? At the end he did not spend a single

centavo. Only the genius of Lopez could have thought of that...

Rizal Philippines

History of Meralco

The real real estate deals are those where little or none of your money is used. And only brilliant deal makers entrepreneurs can do that.

Examples.

1. Purchase of Lopez from GTU of Meralco...

Under the Laurel Langley agreement, all US owned companies in the Phil by 19.., they shall be sold and transferred to Philippine owners, especially the utility firms like Meralco, Channel 7.

Classic was the purchase of Meralco by Lopezes from GTU

1. Lopez using personal money makes a DP; Lopez borrows from PCIBank

2. Lopez executes a Contract for term payment of Meralco (which could probably come from

earnings,) say 10 years

3. Lopez incorporates a holding company to hold the Meralco shares, keeping corporate structure

of Meralco intact: Meralco Securities Lopez of course are the majority stockholders

4. Meralco floats some of the shares at an IPO. The proceeds are used to pay off the PCIBank

loan.

Question: did Lopez use his own money to buy Meralco..? At the end he did not spend a single

centavo. Only the genius of Lopez could have thought of that...

Banks not as piggy banks but as creators of money - a magical event happens

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

How banks create money

I did not finish a business course while in college... I was naive and untutored in the world of business and finance. Our first project after I quit working for someone was to establish a savings and loan association.

My first idea was that banking was a zero sum game, namely that if Bank A has deposit and a new bank, Bank B were to be established, the deposit that may be generated would be equal to or more than the deposit of A. (A piggy bank concept) Little did I understand that a bank does more than that - it creates money. Thus after one year, the rural bank bank A had P2 million in deposits, and Bank B which we established had P5 million in new deposits. Theoretically, our total deposit would be not more than the starting point of Bank 1. - 1 million deposits.

Why is this so? Because the savings and deposit activity of the bank, creates (although not minting) money. We thought that only the BSP can create money. Yes banks create money.

When a bank lends, and assuming the community is a community of savers (there are no cash hoarders) the money lent is paid to others in the community who again deposits the amount of the bank. And depending on the reserve requirement, the remaining free portion is relent and so on. In a community where the reserve requirement is 20%, the multiplier effect is five times (inverse of the reserve requirement) So the P1,000 deposit from loans becomes 5,000. Thus when there is a bank run, banks run out of cash because the jump from P1,000 to P5,000 is a result of magic from fractional reserve system...

The Central Bank does even a greater magic when it prints money. Who says there is a gold backing for our money. There is none..!!. Under the fiat or currency system, a gold reserve is not mandated. The CB may buy from the money or credit it created gold bullions for security, US treasury notes or other valuable asset. but other than that, a central bank creates money from nothing. All are purely

accounting entries

1. To print money, CB does this accounting magic say P1 billion php

Bills and coins P1,000,000,000.00

Bills and coins payable P1,000,000,00.00 Just like that from nothing

2. From loans and discount operations; CB lends to banks

Loans and discount say P500,000,000.00

Deposit of banks P500,000,000

Thus our BSP which has only P10B in equity may support total assets of trillions creating something out of nothing.

Thus to grow a business, you have to create your own currency, IOUS (money is a liability of the Central Bank and the CB governor and the President are the signatories)

1. At the business level, this could be gift certificates, (that can be negotiated and sold) as

what SM did before

2. Your own credit card (say of Walmart, Shell etc)

If you do not know this magic, then you will be left behind.

Rizal Philippines

July 23, 2019

How banks create money

I did not finish a business course while in college... I was naive and untutored in the world of business and finance. Our first project after I quit working for someone was to establish a savings and loan association.

My first idea was that banking was a zero sum game, namely that if Bank A has deposit and a new bank, Bank B were to be established, the deposit that may be generated would be equal to or more than the deposit of A. (A piggy bank concept) Little did I understand that a bank does more than that - it creates money. Thus after one year, the rural bank bank A had P2 million in deposits, and Bank B which we established had P5 million in new deposits. Theoretically, our total deposit would be not more than the starting point of Bank 1. - 1 million deposits.

Why is this so? Because the savings and deposit activity of the bank, creates (although not minting) money. We thought that only the BSP can create money. Yes banks create money.

When a bank lends, and assuming the community is a community of savers (there are no cash hoarders) the money lent is paid to others in the community who again deposits the amount of the bank. And depending on the reserve requirement, the remaining free portion is relent and so on. In a community where the reserve requirement is 20%, the multiplier effect is five times (inverse of the reserve requirement) So the P1,000 deposit from loans becomes 5,000. Thus when there is a bank run, banks run out of cash because the jump from P1,000 to P5,000 is a result of magic from fractional reserve system...

The Central Bank does even a greater magic when it prints money. Who says there is a gold backing for our money. There is none..!!. Under the fiat or currency system, a gold reserve is not mandated. The CB may buy from the money or credit it created gold bullions for security, US treasury notes or other valuable asset. but other than that, a central bank creates money from nothing. All are purely

accounting entries

1. To print money, CB does this accounting magic say P1 billion php

Bills and coins P1,000,000,000.00

Bills and coins payable P1,000,000,00.00 Just like that from nothing

2. From loans and discount operations; CB lends to banks

Loans and discount say P500,000,000.00

Deposit of banks P500,000,000

Thus our BSP which has only P10B in equity may support total assets of trillions creating something out of nothing.

Thus to grow a business, you have to create your own currency, IOUS (money is a liability of the Central Bank and the CB governor and the President are the signatories)

1. At the business level, this could be gift certificates, (that can be negotiated and sold) as

what SM did before

2. Your own credit card (say of Walmart, Shell etc)

If you do not know this magic, then you will be left behind.

Its the businessmen and entrepreneurs who create and deliver value - not the government, not the central bank or banks

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

Many people gravitate towards the government, the central banks and banks currying favor. They think that value and wealth from the economy are sourced from this pipeline. Its the entrepreneurs and the businessmen who create value, deliver and capture these. The business develop this in their business model canvass known as main value proposition.

A banker friend who shifted to cement manufacturing told me that when he became a manufacturer, that is the time he recognized the work and effort of businessmen in nation building. He was a banker for a long time. He realized that bankers simply lived off the hard work and wealth creation activities of producers and manufacturers.

Many of us like the social welfare: jobs, free hospitalization, education comes from the government, Its not true. They come from taxes paid for by the businessmen. Therefore, the govt must befriend businessmen and support them. They are the goose that lays the golden eggs.

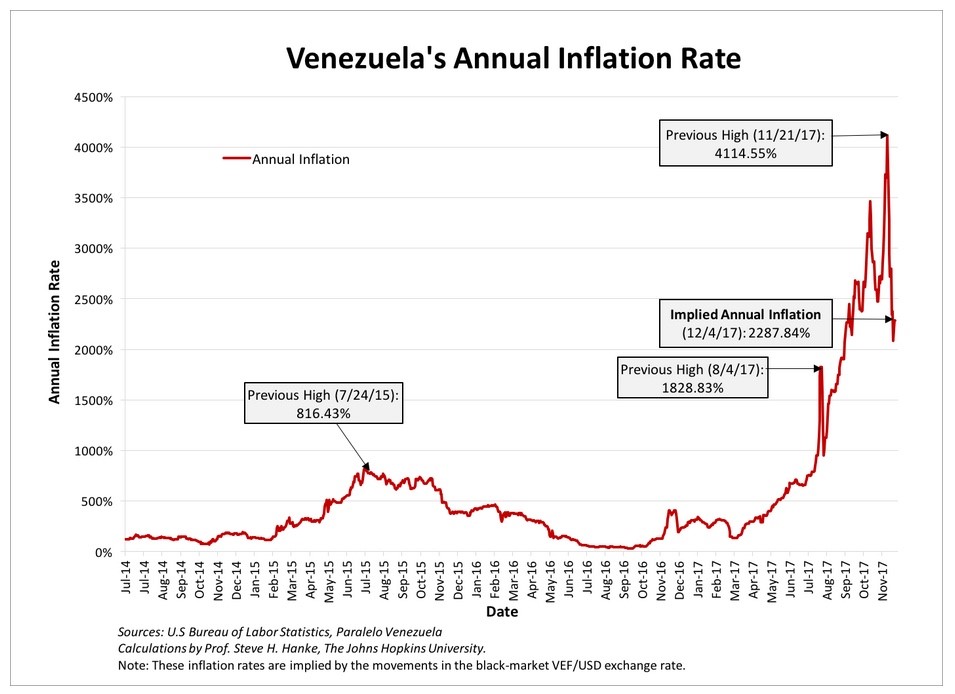

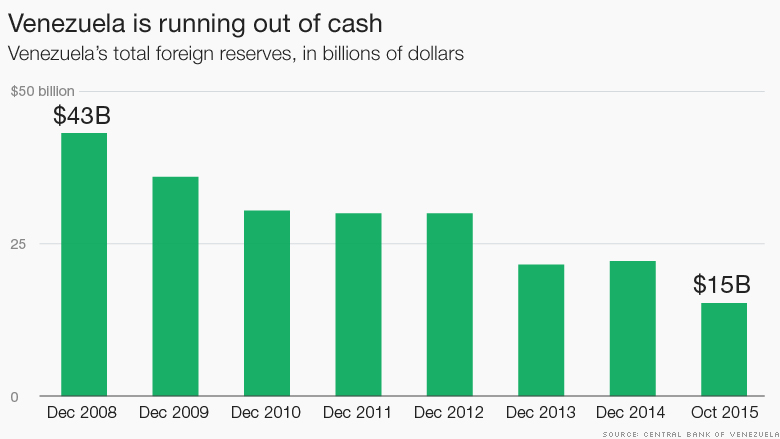

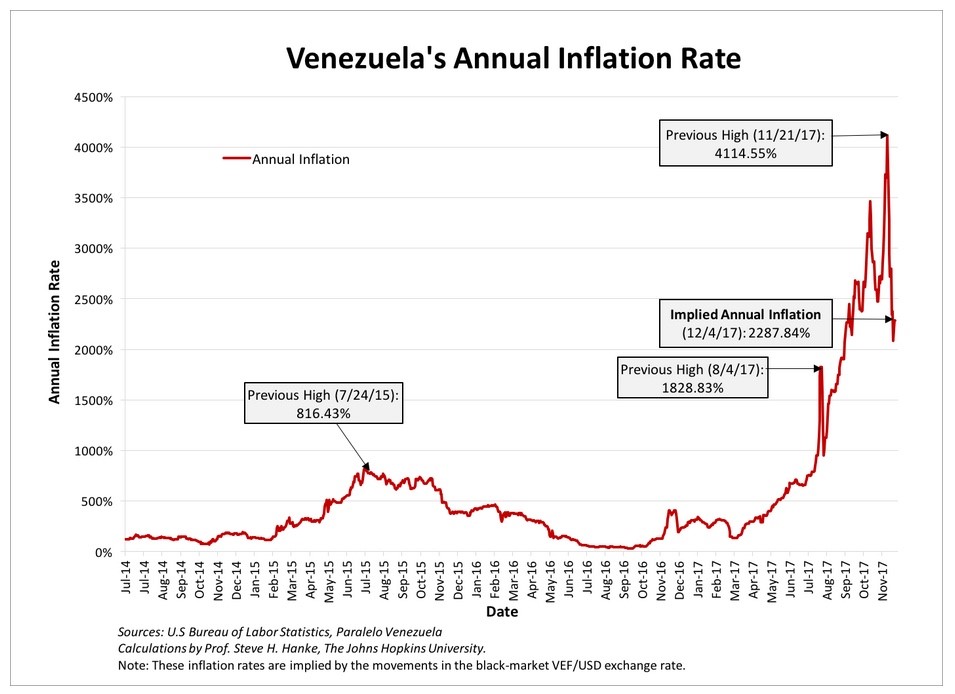

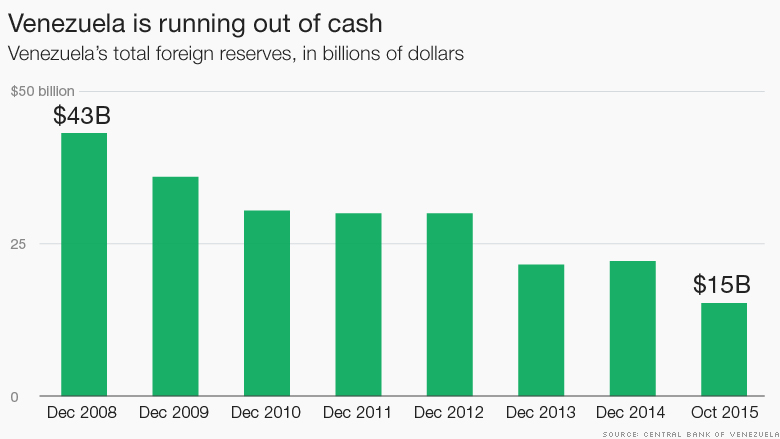

One such govt that failed to recognize this was Venezuela who in the interest of socialism and nationalism nationalized many private businesses. Now the country is in jeopardy, running deficits, huge unbelievable inflation rates, borrowing heavily because the tax base has been diminished by the nationalization... Think about this...

Now this country is experiencing emigration to US and civil disorder. There is widespread poverty and famine

Rizal Philippines

July 23, 2019

Many people gravitate towards the government, the central banks and banks currying favor. They think that value and wealth from the economy are sourced from this pipeline. Its the entrepreneurs and the businessmen who create value, deliver and capture these. The business develop this in their business model canvass known as main value proposition.

A banker friend who shifted to cement manufacturing told me that when he became a manufacturer, that is the time he recognized the work and effort of businessmen in nation building. He was a banker for a long time. He realized that bankers simply lived off the hard work and wealth creation activities of producers and manufacturers.

Many of us like the social welfare: jobs, free hospitalization, education comes from the government, Its not true. They come from taxes paid for by the businessmen. Therefore, the govt must befriend businessmen and support them. They are the goose that lays the golden eggs.

One such govt that failed to recognize this was Venezuela who in the interest of socialism and nationalism nationalized many private businesses. Now the country is in jeopardy, running deficits, huge unbelievable inflation rates, borrowing heavily because the tax base has been diminished by the nationalization... Think about this...

Now this country is experiencing emigration to US and civil disorder. There is widespread poverty and famine

Contrary to popular beliefs, the purpose of a business is to create and keep customers

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

Contrary to popular beliefs that a business is out there to make profit\ for the stake holders, the real primary purpose, according to Peter Drucker is to create customers. Everything about the business - production, finance, logistics, etc should be customer centric... How to make the product responsive to the customer wants and needs, finance to provide easy and convenient financial package for the customer to acquire the products, SCM how to make the products reach the customer fast and in undamaged condition, office to service the account well, and office staff to provide unique customer experience.

Start to worry:

1. When you do not have prospects;

2. When the number of staff exceeds the number of sales;

3. There are many customer complaints...

Muster the energy and the team spirit of everyone for superior customer experience.. Be sure you are tops in that area...

Profit is the score, is the reward for giving superior customer service. If you think about this, your success in business is assured.

Many companies in seeking tops strategic move, think of complex matters. Tops should be the company, the product the customer and competive situaition. Is your product serving the customer well, are you selling superior product (better than competitors) Are you making it easy for the customers to buy from you at affordable cost

A well known FMCG company taking advantage of the RORO overhauled its logistics business. Aside from outsourcing, it reduced its distribution centers to only 3: one in Luzon, one for Visayas and one for Mindanao. The cutting of DC removed delays in transshipping goods from so many DC. From the factory and DC, the following day, the products can be shipped in 24 hours to any point from Luzon to Visayas, and Luzon to Luzon and Mindanao to Mindanao, assuring freshness of the produce (shelf life). and reducing losses from expired (Back Order) products.

Everything starts and ends with the customer

Rizal Philippines

July 23, 2019

Contrary to popular beliefs that a business is out there to make profit\ for the stake holders, the real primary purpose, according to Peter Drucker is to create customers. Everything about the business - production, finance, logistics, etc should be customer centric... How to make the product responsive to the customer wants and needs, finance to provide easy and convenient financial package for the customer to acquire the products, SCM how to make the products reach the customer fast and in undamaged condition, office to service the account well, and office staff to provide unique customer experience.

Start to worry:

1. When you do not have prospects;

2. When the number of staff exceeds the number of sales;

3. There are many customer complaints...

Muster the energy and the team spirit of everyone for superior customer experience.. Be sure you are tops in that area...

Profit is the score, is the reward for giving superior customer service. If you think about this, your success in business is assured.

Many companies in seeking tops strategic move, think of complex matters. Tops should be the company, the product the customer and competive situaition. Is your product serving the customer well, are you selling superior product (better than competitors) Are you making it easy for the customers to buy from you at affordable cost

A well known FMCG company taking advantage of the RORO overhauled its logistics business. Aside from outsourcing, it reduced its distribution centers to only 3: one in Luzon, one for Visayas and one for Mindanao. The cutting of DC removed delays in transshipping goods from so many DC. From the factory and DC, the following day, the products can be shipped in 24 hours to any point from Luzon to Visayas, and Luzon to Luzon and Mindanao to Mindanao, assuring freshness of the produce (shelf life). and reducing losses from expired (Back Order) products.

Everything starts and ends with the customer

Cost and expense reduction is reverse marketing

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 23, 2019

Other way of saying this, "A penny saved is a a penny earned"

The back end, the admin accounting side of business should strive to reduce cost and expenses. In a business every body sells And the way for non marketing people to sell is to reduce cost. The cost and expense you reduce in the operations (and even in marketing) means you do not have to sell that amount to generate the revenue and the contribution to overhead to pay for that expense. If for example you save P1,000 in expense, and your GP rate is 10%, you do not have to sell P10,000 any more

Have time and train your staff and yourself to save reduce cost and expense every time.

Rizal Philippines

July 23, 2019

Other way of saying this, "A penny saved is a a penny earned"

The back end, the admin accounting side of business should strive to reduce cost and expenses. In a business every body sells And the way for non marketing people to sell is to reduce cost. The cost and expense you reduce in the operations (and even in marketing) means you do not have to sell that amount to generate the revenue and the contribution to overhead to pay for that expense. If for example you save P1,000 in expense, and your GP rate is 10%, you do not have to sell P10,000 any more

Have time and train your staff and yourself to save reduce cost and expense every time.

Monday, July 22, 2019

Discipline, Being the First to Market get companies to be great

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 22, 2019

It is the contention of this post, and so with others, that discipline, cohesiveness of the organization to execute , the ability to execute first ahead of the others make for a sucdessful great company. Not technology, high IQ or DNA. Only discipline and team work of the firm,

Hence Peter Senges book on getting people to learn together (5th Disciplline , Jim Collins (Good to Great) disciplined thought, people, execution are I think some of the most practical strategy book todate. What good will a brilliant strategic plan do if we cant get the people to learn, understand what is to be done, much less to do. this.

Rizal Philippines

July 22, 2019

It is the contention of this post, and so with others, that discipline, cohesiveness of the organization to execute , the ability to execute first ahead of the others make for a sucdessful great company. Not technology, high IQ or DNA. Only discipline and team work of the firm,

Hence Peter Senges book on getting people to learn together (5th Disciplline , Jim Collins (Good to Great) disciplined thought, people, execution are I think some of the most practical strategy book todate. What good will a brilliant strategic plan do if we cant get the people to learn, understand what is to be done, much less to do. this.

What are stable companies to invest in? Those that serve basic needs

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 22, 2019

It is the observation of this post that the stable and profitable companies to invest in are those involved in serving customer needs rather than wants: housing, clothing, food, security rather than those that deal in fancy wants, or esoteric products. So those companies would be in food, food distribution, housing insurance financial services, communication services, expressway, office spaces, retailing etc.

Even if we look at the successful Venture Capital funding

40 best venture capital ventures

Those in entertainment music, travel, would be more risky

What do you think.?

N.B. Our dean and classmate in College commented that RE took a beating in the 1997 crisis (due to excesses in Wall St for subprime mortgages, driving down prices and even causing bankruptcy and demise of revered investment banks and creating ripples in the financial capitals of the world; the RE has long recovered because it is a basic need. In NCR Philippines the price per square of meter of condo has seen its price rise up from less than P100k/sm to over P200k per sem and at MoA even to P500k/sm

Rizal Philippines

July 22, 2019

It is the observation of this post that the stable and profitable companies to invest in are those involved in serving customer needs rather than wants: housing, clothing, food, security rather than those that deal in fancy wants, or esoteric products. So those companies would be in food, food distribution, housing insurance financial services, communication services, expressway, office spaces, retailing etc.

Even if we look at the successful Venture Capital funding

40 best venture capital ventures

Those in entertainment music, travel, would be more risky

What do you think.?

N.B. Our dean and classmate in College commented that RE took a beating in the 1997 crisis (due to excesses in Wall St for subprime mortgages, driving down prices and even causing bankruptcy and demise of revered investment banks and creating ripples in the financial capitals of the world; the RE has long recovered because it is a basic need. In NCR Philippines the price per square of meter of condo has seen its price rise up from less than P100k/sm to over P200k per sem and at MoA even to P500k/sm

To get high returns on your investment, invest in places where you see blood on the street

Ateneo Professor on Entrepreneurship

Rizal Philippines

July 22, 2019

Did he read this book?

Did he read this book?

I had a guest in my class, a Chinese, a relative of Lucio Tan, and I recall he was a VP at one of the companies of the tycoon. He compared his career with his relatives who migrated to the relative comfort of Canada. They feared the rallies, the NPA, the Muslim problems He decided to stay and quipped that statement "Invest in places where you see blood on the street." In Europe Japan or USA, it is fortunate that you get 6% ROI in US, 3% in Europe or in Japan 2%.... In the Philippines what is the ROI...

It makes sense to have this contrarian investment streak:

1. You have less competition; you can buy the asset cheap because many will be risk averse

2. There is no way but up; what goes down must come up;

3. LDCs and poor countries look up to Developed Countries thus want new things: cars, appliances

houses.

4. High risk high gain

5. No guts no glory

So we see Henry Sy investing in MoA, Megamall, and SM North during times of crisis.; (For the Chinese Ji Wei, opportunities and risk character look the same,. We look for opportunities in risk. There is risk, yes, but look first positively on the opportunity...)

His cousins came home to retire here in the Philippines several decades after. What happened to them? Well retired civil servants. And what happened to him. He is a senior officer at LT. And owns several businesses like a Cable TV company to name others...

So you see many investments made in emerging economies. Africa, Asia, Bangladesh Middle East. Especially China making forays into these areas. US and Europe placed their bets with the Philippines and what did they get. We had students from Shell Intl who viewed investment in PHL as great despite having demos vs oil price hikes, riots etc. They are here for the long term...

40 Best VC Investments in the Modern Era

Rizal Philippines

July 22, 2019

I had a guest in my class, a Chinese, a relative of Lucio Tan, and I recall he was a VP at one of the companies of the tycoon. He compared his career with his relatives who migrated to the relative comfort of Canada. They feared the rallies, the NPA, the Muslim problems He decided to stay and quipped that statement "Invest in places where you see blood on the street." In Europe Japan or USA, it is fortunate that you get 6% ROI in US, 3% in Europe or in Japan 2%.... In the Philippines what is the ROI...

It makes sense to have this contrarian investment streak:

1. You have less competition; you can buy the asset cheap because many will be risk averse

2. There is no way but up; what goes down must come up;

3. LDCs and poor countries look up to Developed Countries thus want new things: cars, appliances

houses.

4. High risk high gain

5. No guts no glory

So we see Henry Sy investing in MoA, Megamall, and SM North during times of crisis.; (For the Chinese Ji Wei, opportunities and risk character look the same,. We look for opportunities in risk. There is risk, yes, but look first positively on the opportunity...)

His cousins came home to retire here in the Philippines several decades after. What happened to them? Well retired civil servants. And what happened to him. He is a senior officer at LT. And owns several businesses like a Cable TV company to name others...

So you see many investments made in emerging economies. Africa, Asia, Bangladesh Middle East. Especially China making forays into these areas. US and Europe placed their bets with the Philippines and what did they get. We had students from Shell Intl who viewed investment in PHL as great despite having demos vs oil price hikes, riots etc. They are here for the long term...

40 Best VC Investments in the Modern Era

Subscribe to:

Comments (Atom)