Natural gas abounds in the US. Therefore it is cheap. China, Asia and Europe wants that

cheap natural gas.

There is also the new fracking technology (mentioned in other posts) that removes pollution from fracking. Fracking increases the yield of oil from shale fields.

A new age has come to the US and will probably avert recession, inflation etc. financial doom

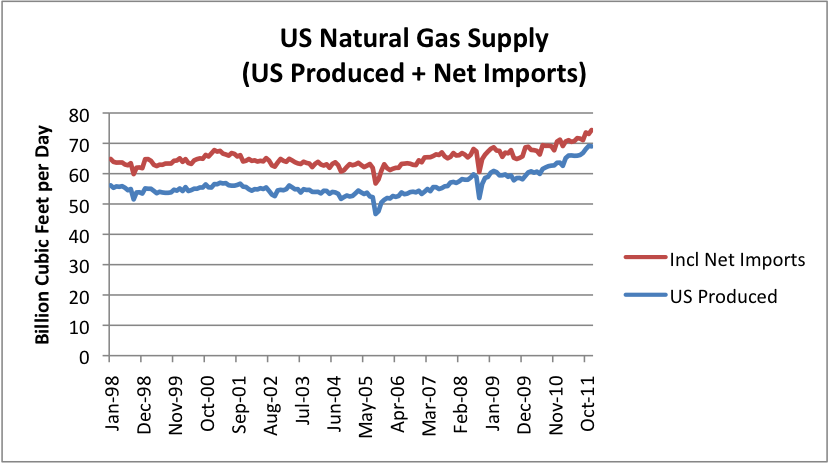

Production is going up; prices are going down; it is now only $2.57/tcf

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Sat, May 26, 2012 at 8:10 PM

Subject: Cookin' with Gas

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Sat, May 26, 2012 at 8:10 PM

Subject: Cookin' with Gas

Cookin' with Gas

By Nick Hodge | Saturday, May 26th, 2012

You should be out enjoying beer, barbecue, and burgers this weekend, so I'll keep this brief.

The biggest energy investment happenings this week centered on natural gas.

First, research firm Wood Mackenzie came out with some estimates that bode very well for U.S. shale gas exports...

It says by 2020, Europe will be using more U.S. shale gas than European.

The EU's dependence on imported gas will increase to 86%.

Advertisement

Iran's Threats Could Make You Rich!

It's simple: Tension in the Middle East drives up energy prices.

This also makes the share prices of certain North American companies skyrocket — handing early investors like you massive gains.

The companies that stand to profit the most are outlined in this free report.

It also said China will increase LNG imports by 80% to meet domestic demand by 2030.

Natural gas in Europe costs $10 per thousand cubic feet (tcf) right now and even more in Asia. It's going for $2.57/tcf in the States.

So you can bet the rest of the world wants to get their hands on that cheap gas.

Ain't Seen Nothin' Yet

I know the phrase "fracking boom" has been tossed around a lot lately.

And if one was already under way, it's about to go sonic...

The Ohio House and Senate have now passed a law that will allow fracking to grow responsibly.

It will require companies test water within 1,500 feet of proposed wells, report the fluids and chemicals used in drilling, and track the wastewater after it's injected into disposal wells.

The bill has paved the way for Ohio to add 65,000 jobs and $5 billion in shale gas investment in the next two years. The number of wells there is expected to grow 3,025% by 2015 as a result.

Other states are working on similar measures that will allow fracking to expand while holding drillers accountable.

Advertisement

The End of an Era

Steel gave us the Iron Age.

The industrial revolution brought us the Oil Age.

Right now we're in the Silicon Age.

But a new age is beginning to dawn. And it will change everything you thought you knew.

Even better for the industry and its investors, new fracking methods are being perfected that use no harsh chemicals or water at all.

These methods will do wonders to appease environmentalists — not to mention be beneficial for the bottom line.

Right now, it can cost as much as $15 for every barrel of wastewater that has to has to be hauled away from a frack site. The industry uses more than 56 million barrels of water each day.

This waterless fracking method is already being used by Chevron, Shell, and many other drilling giants.

It's going to kick the fracking industry into overdrive...

And it's all controlled by a $4.00 company that's a screaming buy right now.

You can see how it works here — and why you should consider investing.

Call it like you see it,

Nick Hodge

Editor, Energy and Capital Investing in Metals: Stealing China's Monopoly on this Prized Miracle Material Scientists have hailed this new resource as the next game-changer for technology. The uses for this metal are endless.

The Single-Most Reliable Form of Extra Income: You Could Be Passing Up Thousands of Dollars a Month

Join the thousands of people who are already receiving a check in their mailbox every month from some of the world's biggest billion-dollar retailers.

Obama's Got Gas (It's Natural): What to Do with a Glut of Gas

Just as we saw in the early days of the U.S. petroleum industry, the real investment potential lies with infrastructure.

Coal Investment Opportunities: Three Ways to Invest from the Death of Coal

Coal-fired power production is dwindling, but exports are set to soar.

Keynes, Mustangs, and Oil Prices: Bill Gates' Burger

There is perhaps nothing quite so agreeable as a hot spring day, laughing children and burning burgers. And despite my best intentions, I burnt them black and crisp.

Deepwater Oil Investing: Three Stocks to Buy in a Market Slump

Energy and Capital Editor Keith Kohl takes a look at the $175 million gamble these investors lost.

The Solar Blood is in the Street: Solar Industry Cliffs Notes

In 1946 the first ever general purpose computer weighed 27 tons and cost over $5 million to build. I think today is the 1946 of the solar industry... and dismissing it now would be just as foolish as dismissing the computer industry back then.

1.5 Billion Barrels of Oil Found in Ohio: New Drilling Method to Turn Ohio into The Next Bakken

This company's drilling method received "technological innovator of the year award" for 2011. This is the future of shale drilling. Period.

Fossil Fuel Cold War Brings America Back: The New 1%

Unless you've been living under a rock, you probably already know at least something about the oil-shale boom going on in the Western United States and Canada. What I want to tell you about today is the next step in America's steady return to the top of the global energy food chain.

Solving Fracking's Water Issue: Frack This

The EPA has evaluated homeowner water wells near fracking operations and determined that no chemical or pollutant occurred in a quantity worthy of further regulation or action. But if that's not good enough for you, consider this...

Taxing Fat: Obesity in America: What About the 66 Percent?

Analyst Ian Cooper takes a look at the only two obesity drug stocks to own this summer.

Investing in Fracturing Technology: The Next Generation Frack

Today I want to show investors one alternative to hydraulic fracturing that's about to steal the spotlight from the shale revolution.

The Bottom Line

Related Articles

Solving Fracking's Water IssueFracking Water Market Contamination Not Linked to Fracking, Study Says Carbo Sand Shortage Results In Abysmal Share Prices

Recently...

Frack ThisThree Stocks to Buy in a Market Slump Solar Industry Cliffs Notes Three Ways to Invest from the Death of Coal Energy and Capital's Weekend Edition | |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

No comments:

Post a Comment