The European Central Bank in Frankfurt Germany

The prescription of the Sovereign Man is to eliminate central planning and for that matter Central Bank.

If there would be no

Central Banks, the followiing would be the advantage:

l. The private companies would not take unnecessary risks since there could be no bail outs or savior;

2. Governments would likewise be constrained to balance their books since they could not monetize their debt, or cause printing of money which is inflationary and destructive.

A US Central Bank

Arab Central Bank

Central Banks are enemies of sovereign men; of sovereign citizens because they cause the ordinary men to be poorer by their mistakes.

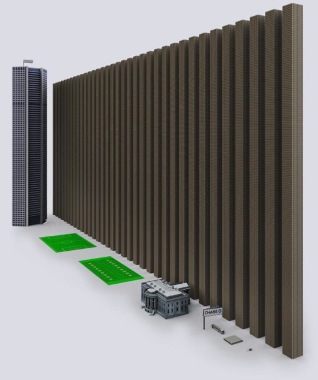

What hits me is the derivative exposure of JP Morgan, $70 trillion the size of the world economy. If it were to collapse now..... Can a Central Bank, or consortium of Central Bank save JP Morgan and the world from this financial disaster? If you pile up all the money, I trillion dollars would be as tall as their HQ building and multiply that 70x. That is staggering. Are these assets solid, or are they being propped by other risky derivatives like the ones that sucked $2billion from the prestigious institution?

Will they not go by way of Bear Stearns or Lehman Brothers?

My mental models of IB at Wall Street which is the summit of success in business finance and deal making all but collapsed, was vaporzied entirely.

Towering Building and Towering Risky Assets

JPM Exposure to Derivatives is Too Risky and Scary

----- Forwarded Message -----

From: Simon Black <admin@sovereignman.com>

Sent: Tuesday, May 15, 2012 12:01 AM

Subject: A great example of the coming financial repression

From: Simon Black <admin@sovereignman.com>

Sent: Tuesday, May 15, 2012 12:01 AM

Subject: A great example of the coming financial repression

Having trouble viewing this email? Read it on our website.

Sovereign Man

Notes from the Field

Date: May 14, 2012

Reporting From: London, England

[Editor's note: Tim Price, frequent Sovereign Man contributor and Director of Investment at PFP Wealth Management in the UK, is filling in for Simon today.]

Imagine you are one of two people playing Monopoly. While you follow the rules religiously, the other player, who also happens to be the banker, does not. He routinely appropriates properties. If he doesn't like the score on the dice, he simply changes them. He continually takes as much money from the bank as he likes. Whenever the rules don't suit he arbitrarily alters them in his favour. Oh, and he hates to lose. Rather than concede defeat, he is perfectly willing to set fire to the table. Genetic explanation for Obama's social welfare: New research suggests carriers of a particular gene may be predisposed to certain ideological and political beliefs. Are you a carrier? Click here for the full details and to learn why this may even affect how you generate wealth. Imagine no longer. This is the state of the financial markets. You are playing against the world's central banks. For some time now, the Financial Times has been running articles (under the inauspicious label of 'Collateral Damage') discussing the merits or demerits of central banking. Only one contributor, Ron Paul, has challenged the status quo: "[W]hile socialism and centralised economic planning have largely been rejected by free- market economists, the myth persists that central banks are a necessary component of market economies." Every other contributor thus far has sought to defend central banking as a necessary part of the system... a view that seems categorically embraced by most people. In browsing through the comments of Dr. Paul's FT article, for example, one reader posted: "The problem with blindly accepting Dr Paul's diagnosis is that he lacks the necessary qualifications to make a diagnosis. Would you trust a medical diagnosis made by Ben Bernanke, Mario Draghi or Mervyn King ?" No, I wouldn't. But I wouldn't trust an economic diagnosis from any of those individuals either. Given their track records, why would anyone? Getting rid of central banks (over time, let us be realistic) would have several effects. First, it would require insolvent commercial or investment banks to fail properly, as opposed to feeding off the blood of taxpayers indefinitely. As an example, lest anyone regard the $2 billion loss recently announced by JP Morgan as comparatively trivial, it should perhaps be seen in the context of the same bank's overall derivatives exposure, which is shown graphically below.  JP Morgan's total derivatives exposure stands at $70.1 trillion, or roughly the same size as the entire world economy. Each of the $1 trillion towers in the image is double-stacked to a height of 930 feet (283 meters). Second, eliminating central banks would require governments to balance their books, no longer able to monetize the debt through its relations with the central banker. Third, asset prices would revert to being determined by the market, and not by unelected economist serving the interests of bankers and politicians. As this is clearly not going to happen anytime soon, most investment managers seem content to embrace the system and continue playing the cards they've been dealt. To give you an example, the FT reported that, last year, US pension funds for the very first time put more of their assets into bonds as opposed to equities. Like many investors, these fund managers fail to understand the risks they're running and seem to have accepted the convention that nothing could possibly go wrong while central bankers are in charge. Yet with Treasury yields as low as they are, this is unlikely to end well. The chart below shows the impact on investors who purchased British Gilts during the stagflation suffered in the UK during the 1970s.  Investors who bought conventional Gilts in 1973 had to wait for 12 years to earn a positive real return on their investment. And this is exactly the sort of financial repression we have to look forward to under the current system controlled by the political and central banking elite. Tim Price Director of Investment PFP Wealth Management Sovereign Man Contributor

Discover an unknown passport loophole [until now]

If you haven't subscribed yet to Sovereign Man: Confidential, you're missing out. In this one single issue, you could have learned:

And much, much more.

Simon is the only person who actually lives this lifestyle and walks the walk. Just this month he worked with a high level government official on immigration and met with bankers from Singapore to London.

Start taking advantage of this boots on the ground intelligence today, and sign up for a RISK FREE trial to Sovereign Man: Confidential.

Neither this email communication nor content posted to the website SovereignMan.com is intended to provide personal financial advice. Before undertaking any action described in this letter, financial or otherwise, you should discuss your options with a qualified advisor-- accountant, financial planner, attorney, priest, IRS auditor, Tim Geithner... Also, nothing published in this letter constitutes encouragement to avoid or evade tax obligations in your home country. Furthermore, you should understand that SovereignMan.com may in some instances receive financial compensation for products and/or services which are mentioned in the letter, and in other cases, SovereignMan.com receives no compensation. The needs of the community come first, and the presence or lack of financial compensation in no way affects the recommendations made in this letter.

Blacksmith Pte. Ltd. publisher of Sovereign Man No.4 Kiarong Complex Gadong 2nd Floor Block D BSB, Brunei-Muara BE1318 Brunei Darussalam

If you'd like to update your email address or no longer wish to receive our daily emails, click the link below: so

|

No comments:

Post a Comment