The advice here is a classic example of Ji-Wei - opportunity in threats/risk. The advice says that there is great opportunity for oil and energy because of Iran threat in the middle east. The threat of war drives up oil prices like crazy and therefore oil plays are profitable.

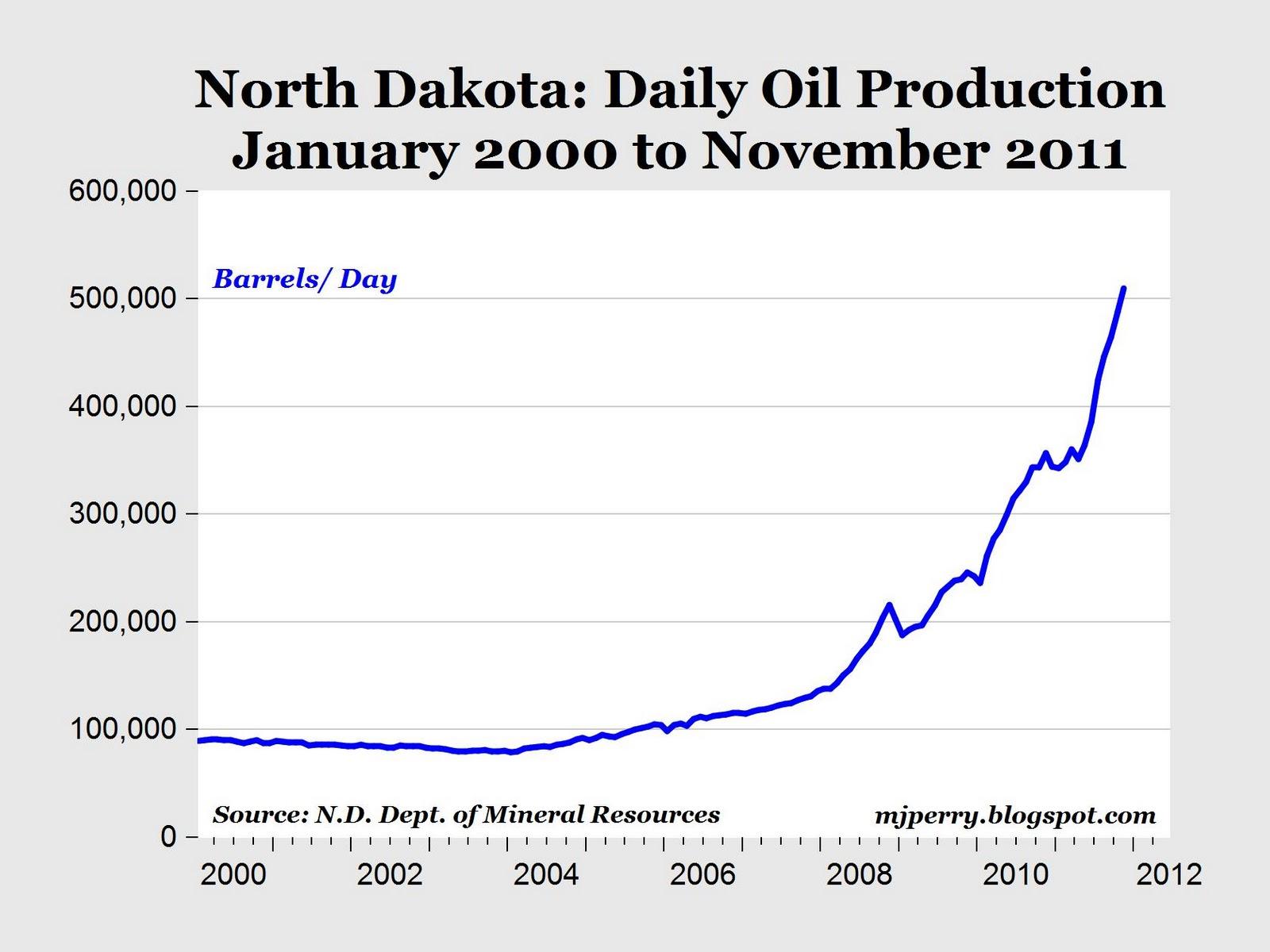

Remember this Bakken, North Dakota, the new oil drillers shale oil drilling paradise.

---------- Forwarded message ----------

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Wed, May 16, 2012 at 3:08 AM

Subject: Don't Miss This Buying Opportunity

![]()

From: Energy and Capital <eac-eletter@angelnexus.com>

Date: Wed, May 16, 2012 at 3:08 AM

Subject: Don't Miss This Buying Opportunity

Don't Miss This Buying Opportunity

By Keith Kohl | Tuesday, May 15th, 2012

Publisher's Note: We're opening our most prestigious investment group for membership. This happens only once each year.

It's for investors like you who want to sidestep "the system" and learn how to grow and protect wealth on your own...

By accepting this invitation — and becoming a partner in this elite trust — you'll learn how to do just that, while getting access to the kinds of investments once reserved for only the financial elite.

To your wealth,

Brian Hicks

"It's the perfect storm here for drillers, Keith. Not a dry hole in sight."

That's how I was greeted by an old friend as I stepped onto the rig last week.

I've heard these same words time and again since my first visit to the Bakken.

And I can't blame my friend for his rosy outlook...

The rig he runs happens to be in one of the hottest oil fields in the United States.

Advertisement

Facebook's $50 Billion Gift to You

The tech IPO of the century is about to happen...

And early investors stand to make a killing.

Traditionally these IPO profits have been limited to millionaire venture capitalists and Big Banks...

But with the release of this new report, all that is about to change. Get your free copy on how to profit from Facebook's $50 billion gift. Click here.

Two Reasons to Remain Bullish

As well as things are going for my buddy up in the Bakken, things are about to get even bigger there.

Growth is coming — and all we have to do is look to the United States Geological Survey for affirmation.

Last May, Secretary of the Interior Ken Salazar announced the USGS will be updating their 2008 Bakken assessment.

Just how important is this update and these new oil fields?

Remember that not every well is a gusher. In fact, the opposite is true more often than not when it comes to our domestic production...

These "non-gusher" wells are known as stripper wells — and most people don't realize how much we count on them.

Simply put, a stripper well is an oil well that produces fewer than 10 bbls/day — or a natural gas well that produces fewer than 60 Mcf/d.

Together, they account for nearly 15% of our oil supply and 8% of our gas production.

As you can see above, approximately 80% of our producing wells in the United States are classified as stripper wells, giving new meaning to the phrase "scraping the bottom of the barrel."

Good thing there's one sure way we can stay ahead of the game...

Advertisement

Iran's Threats Could Make You Rich!

It's simple: Tension in the Middle East drives up energy prices.

This also makes the share prices of certain North American companies skyrocket — handing early investors like you massive gains.

The companies that stand to profit the most are outlined in this free report.

Mass Migration

The exodus to these shale plays has already begun, and North Dakota is just one example to follow.

That much should be evident from the mass of people heading to the state in droves — tens of thousands making their way there, each one looking to cash in.

There's a reason unemployment is under 1% in the heart of the formation...

According to the Bureau of Economic Analysis, per capita personal incomes in Billings County, North Dakota, jumped by 46.8% between 2009 and 2010.

But you don't need to pitch a tent in North Dakota to grab your own piece of the Bakken pie...

20 Billion Reasons to Invest in the Bakken

There's something for everyone in the Bakken.

Over the last few weeks, we've seen infrastructure investments that are building the pipes and railways that will carry the high-quality crude to market, some of which are offering the safest annual dividends available.

And no matter how bullish we are on these long-term plays, there's one group in particular that will always have a place in our portfolio...

Those companies that are driving the unconventional oil boom taking place today.

They're responsible for running the 2,000 drilling rigs across North America, increasing production every quarter.

When the USGS announced they're going back to Bakken to reassess the amount of undiscovered, technically-recoverable oil and gas available, the opportunity was clear...

Remember, their 2008 survey propelled the shale play into the national spotlight.

Just imagine the profits the next round of USGS projections will bring.

Back in 2008, the USGS was calling for 4.3 billion barrels in the area — but some oilmen have projected that number to be closer to 20 billion.

Five years ago, I told my readers the Bakken play was just beginning.

After we banked our first triple-digit winners a year later, many newer investors felt as if they'd missed the boat...

To that, I say prepare for Act Two.

Here are three undervalued Bakken stocks to help get you started.

Until next time,Keith Kohl

A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital as well as Investment Director of Angel Publishing's Energy Investor. For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations — all ahead of the mainstream media. For more on Keith, go to his editor's page.

The Bottom Line

| |

This email was sent to jorgeus.george@gmail.com . You can manage your subscription and get our privacy policy here.

Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

No comments:

Post a Comment